In 2026, “ESG” is everywhere – but too often treated as a monolith. In reality, the three pillars – Environmental, Social, and Governance – are distinct domains, each with its own risks, metrics, and strategic implications. Mastering sustainability means understanding them separately and together.

True business resilience comes not from checking ESG boxes, but from managing environmental limits, social equity, and ethical governance as interconnected drivers of long-term value.

Environmental: Operating Within Planetary Boundaries

The Environmental pillar assesses how a business affects natural systems. It includes:

- Climate impact: Measuring and reducing greenhouse gas emissions across Scopes 1, 2, and relevant Scope 3 categories. Under the EU’s CSRD, companies must now report emissions using the GHG Protocol or equivalent standards.

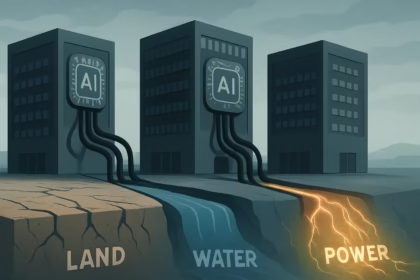

- Resource use: Managing water consumption, land use, and raw material extraction – especially for commodities covered by the EU Deforestation Regulation (effective December 2024, fully enforced in 2026).

- Pollution and waste: Minimizing plastic use, chemical discharge, and landfill contributions. Extended Producer Responsibility (EPR) laws in the EU and Canada now hold brands financially accountable for end-of-life product management.

- Biodiversity: While not yet universally mandated, the Taskforce on Nature-related Financial Disclosures (TNFD) framework is increasingly adopted by financial institutions and large corporates to assess ecosystem impacts.

A software company’s environmental footprint isn’t zero – it’s embedded in cloud computing energy use, employee commuting, and hardware lifecycle. Every business has material environmental impacts.

Social: Building Trust Through People-Centric Practices

The Social pillar examines how a company affects people – employees, communities, customers, and supply chain workers:

- Workforce well-being: Fair wages, occupational health and safety, diversity, inclusion, and mental health support. Under CSRD, large EU companies must now disclose gender pay gaps and measures to ensure equal treatment.

- Supply chain due diligence: The EU Corporate Sustainability Due Diligence Directive (CSDDD), applicable from 2026 for large firms, requires companies to identify, prevent, and address adverse human rights and environmental impacts in their value chains – including Tier 2 and Tier 3 suppliers.

- Community engagement: Respecting Indigenous rights, local water access, and cultural heritage – especially in extractive or infrastructure projects.

- Product responsibility: Ensuring safety, data privacy, and ethical design – critical in tech, finance, food, and healthcare.

Social risk is operational risk. A supplier scandal, data breach, or workplace safety failure can trigger legal penalties, customer attrition, and investor divestment.

Governance: The System That Makes ESG Real

Governance is the structure that ensures accountability for Environmental and Social commitments:

- Board oversight: Leading indices like MSCI and S&P now expect boards to have designated ESG expertise and regular reporting on sustainability risks.

- Ethical conduct: Robust anti-corruption policies, whistleblower protection mechanisms, and political spending transparency.

- Data integrity: CSRD requires limited assurance (audit) of sustainability disclosures by 2-26-28, depending on company size. Narrative claims without data are no longer acceptable.

- Stakeholder capitalism: Moving beyond shareholder primacy to formally consider employees, communities, and long-term societal impact in corporate governance codes (e.g., UK Corporate Governance Code, 2024 update).

Weak governance turns sustainability into greenwashing. Strong governance turns it into strategy.

Why the Pillars Must Be Integrated

These domains are deeply interconnected:

- A food company’s environmental water overuse can violate local social rights and trigger governance investigations.

- A bank’s governance decisions on AI lending algorithms affect social equity and environmental financing flows.

- Poor social labor conditions in a garment factory lead to governance failures (lack of oversight) and environmental waste from high turnover and rework.

Leading companies don’t manage ESG in silos. They embed it into enterprise risk management, capital allocation, and innovation strategy.

Where to Start: Focus on Materiality

Not every ESG issue matters equally to every business. A digital marketing agency faces different material risks than a chemical manufacturer. Use a double materiality assessment – required under CSRD – to evaluate:

- How sustainability issues affect your financial performance (financial materiality)

- How your operations affect people and the environment (impact materiality)

Then prioritize:

- Environmental: Measure your top emission source; switch to renewable electricity.

- Social: Conduct a human rights risk assessment on one high-risk supplier.

- Governance: Assign board-level responsibility for ESG oversight; define KPIs tied to executive compensation.

In 2026, stakeholders don’t expect perfection. They expect honesty about your most significant impacts – and credible action to address them.